If you are a current frequent flyer member, you can explore this blog to maintain your account status active.

Some folks have their travel plans (or flight plans) postponed amid the global pandemic isn’t over in 2021. While the COVID-19 vaccine is on the way to conclude the pandemic, it is essential to wait a little longer to the general public and around the world to get it as soon as possible. I know that it is getting more challenging because you get used to plane rides numerous times annually. It can be challenging for frequent flyer members because flying is primarily to earn more miles on the account, but what are ways besides flying? You will examine options to earn miles below.

Keep in mind that some frequent flyer program’s miles or points expire after a specific time frame .e.g., 12 to 18 months from the last activity. Please, check on your airlines’ account for your miles/points, and if you want to earn miles/points, there are options other than flying. Surprisingly, there are ways to earn more miles/points. You can refer options below.

Frequent Flyer Programs with the expiration date:

| Frequent Flyer Program with code | Expiry Date? | Duration from the last activity |

| Alaska Airlines Mileage Plan (AAMP) | Yes | 24 months |

| American Airlines AAdvantage (AAA) | Yes | 18 months *Except for members under 21 years of age |

| Delta Air Lines SkyMiles (DALS) | No | Infinite period |

| Frontier Miles (FM) | Yes | 180 days |

| Hawaiian Airlines HawaiianMiles (HAH) | Yes | 18 months |

| JetBlue TrueBlue (JT) | No | Infinite period |

| Southwest Airlines Rapid Rewards (SARR) | Yes | 24 months |

| United Airlines MileagePlus (UAM) | No | Infinite period |

So if my frequent flyer program has an expiration date, what are my options to keep my account active beside traveling?

Anonymous

Option 1: Frequent Flyer Program’s Dining and Shopping Partnerships

There are the airline’s partnered dining and shopping programs partnerships with the airline’s program. Keep in mind that some frequent flyers programs don’t have all of the options, so research alternative options to earn more miles.

You can refer below for more options that have either Dining or Shopping linked to the Frequent Flyer Program.

Sign up by logging into your airline’s account. Check into these programs below if they are available.

Frequent Flyer Program with Dining and Shopping partnerships:

| FFP Code | Dining? | Shopping? |

| AAMP | Mileage Plan Dining | Mileage Plan Shopping |

| AAA | AAdvantage Dining | AAdvantage eShopping |

| DALS | Delta SkyMiles Dining | SkyMiles Shopping |

| FM | None | None |

| HAH | None | HawaiianMiles Online Mall |

| JT | TrueBlue Dining | TrueBlue Shopping |

| SARR | Rapid Rewards Dining | Rapid Rewards Shopping |

| UAM | MileagePlus Dining | MileagePlus Shopping |

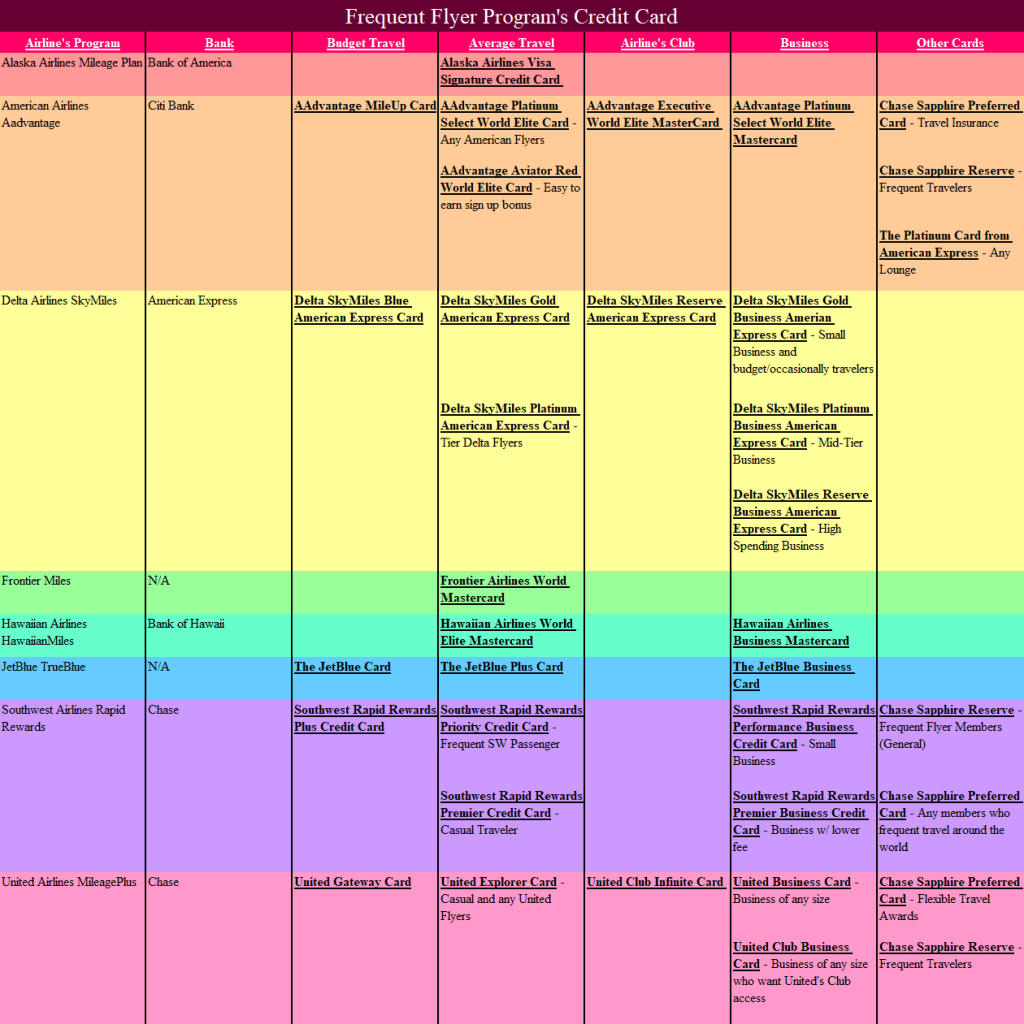

Option 2: Travel Reward Credit Cards

If you prefer to spend some buck on the everyday purchase, there are other options: credit card. Credit cards are excellent options for those who have a good to excellent credit score. Keep in mind that most airline credit cards have an annual fee and an APR of between 17% to 25%, so if you are a budget traveler, you can opt for no-annual-fee or lower-fee cards.

Note: You must pay (if you can) an outstanding balance at the end of the billing cycle to keep it up with your credit. Missing any payment dramatically impacts your credit score, sabotage your future credit needed to buy a house, buy a car, get a loan, pass an employment credit check, etc.

Info: For American Airlines’ credit cards, you must have an excellent credit score to qualify.

Frequent Flyer Program’s Credit Cards:

Note: Southwest Rapid Rewards Plus Credit Card has an annual fee of $69.

If you haven’t decided which credit cards are right for you, you are not alone. You can take more time to research your options to determine if you want to apply for a credit card. ThePointsGuy contributor Blancaflor (2020) has insinuated the overall best reward credit cards below for more options if you are a current member of a particular airline.

The best airline rewards credit cards (December 2020)

- Chase Sapphire Preferred Card: Best for total value

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard®: Best for American Airlines business travelers

- Capital One Venture Rewards Credit Card: Best for easy-to-use rewards

- Delta SkyMiles® Gold American Express Card: Best for occasional Delta flyers

- Delta SkyMiles® Platinum American Express Card: Best for regular Delta flyers

- Citi® / AAdvantage® Executive World Elite Mastercard®: Best for Admirals Club access

- United Explorer Card: Best for United flyers

- Alaska Airlines Visa Signature® credit card: Best for earning Alaska Airlines miles

- Southwest Rapid Rewards Performance Business Credit Card: Best for Southwest Airlines business travelers

- Delta SkyMiles® Reserve American Express Card: Best for elite Delta flyers

- JetBlue Plus Card: Best for JetBlue flyers

Option 3: Buy miles/points

Here is the overall airline’s average value of airlines (Holzhauer, 2020).

Note that this table is not a reference to buy your miles/points. See the next table.

| Airline’s Program | Average Value of 1 mile/Point | Value per $1 | Value per 2,000 miles/points |

| Mileage Plan | 1.0₵ | 100 points | $20.00 |

| AAdvantage | 1.0₵ | 100 miles | $20.00 |

| SkyMiles | 1.3₵ | ~77 miles | $26.00 |

| Frontier Plus | 2.5₵ | 40 miles | $50.00 |

| Hawaiian Miles | 1.1₵ | ~91 miles | $22.00 |

| JetBlue TrueBlue | 1.6₵ | ~63 miles | $32.00 |

| Rapid Rewards | 1.5₵ | ~67 points | $30.00 |

| MileagePlus | 1.1₵ | ~91 miles | $22.00 |

Other options include buy miles but before you begin, think how much is the miles worth because you don’t want to spend a hefty price by buying many miles needed for your free flight* because the average cost is 2.96 ₵ per mile. That’s an average of $59.20 for 2,000 miles/points purchase with an average value of ~34 miles/points per $1 spent. Here is the table of the purchasing value of an airline by miles/points:

*Free flight doesn’t mean “Free.” You must pay the mandatory taxes (security, 9/11, federal taxes) to confirm the flight itinerary.

| Airline’s Program | Purchasing value of 1 mile/point | Value per $1 spent | Value per 2,000 miles/points |

| Mileage Plan | 2.75₵ | ~36 miles | $55.00 |

| AAdvantage | 2.95₵ | ~40 miles | $59.00 |

| SkyMiles | 3.5₵ | ~29 miles | $70.00 |

| Frontier Plus | 2.5₵ | 40 miles | $50.00 |

| Hawaiian Miles | 3₵ | ~33 miles | $60.00 |

| JetBlue TrueBlue | 2.75₵ | ~36 points | $55.00 |

| Rapid Rewards | 2.75₵ | ~36 points | $55.00 |

| MileagePlus | 3.5₵ | ~29 miles | $70.00 |

Note: Buying miles isn’t recommended because the miles/points’ value is not a good deal. Better to opt for other options unless there is the bonus offers to double your miles.

Example: Suppose I saw a United MileagePlus program promotions about bonus miles when purchasing the miles, “Get up to 100% bonus miles when you buy miles.” It looks too good to be true, but I buy more miles with the bonus. Why? United Airlines is trying to attract members to earn miles because of the pandemic to boost its revenue and marketing. I selected the options that maximize the rewards of 109,000 miles with a bonus of another 109,000 miles. That’s the total miles of 218,000 miles with the cost of $3,815. That’s the purchasing value of 1.71₵ (a good deal). Whew!

Remember that if there is no bonus offer, then the purchasing value of 3.5₵ per mile is not a good deal.

Exception: You can afford how much you are willing to spend at the lower tier, not how many miles you are going to earn. If you are short of booking flights on your rewards, you can include your miles on the account.

I do not recommended buying miles because is not worth the value unless you earn “Miles” or “Points” when you are partnered with other venders, etc.

Option 4: Hotels

There are plenty of hotel offers, but there are a limited selection and brand name of the hotel to stay in a while earning more miles. Double-check with the airline’s program for clarification. Here is the table of hotel booking with this handy table of frequent flyer program you are currently a member of:

| Airline’s Program | Hotels |

| Mileage Plan | Alaska Airlines Hotels Rocketmiles |

| AAdvantage | American Airlines Hotels Rocketmiles Pointhound |

| SkyMiles | Hotel & Airbnb Partners |

| Frontier Miles | Limited1 |

| HawaiianMiles | Limited1 Rocketmiles |

| TrueBlue | Limited1 |

| Rapid Rewards | Southwest Hotels Rocketmiles |

| MileagePlus | United Airlines Hotels Rocketmiles |

1Limited partner from the airline’s website to earn miles/points. Subject to change without notice.

Option 5: Car Rentals

| Airline’s Program | Car Rental |

| Mileage Plan | Alaska Airlines Car Rental |

| AAdvantage | AAdvantage Car Rental Partners |

| SkyMiles | Delta Car Partners |

| Frontier Miles | Limited1 |

| HawaiianMiles | Limited1 |

| TrueBlue | Limited1 |

| Rapid Rewards | Southwest Car Rental |

| MileagePlus | Transportation Partners |

1Limited partner from the airline’s website to earn miles/points. Subject to change without notice.

Option 6: Opinions

Another way to earn miles/points is free surveys and opinions. Before you can sign up, be sure that you are a current airline’s program in which you are in.

| Airline’s Program | Opinion Offered? | Name of Opinion |

| Mileage Plan | Yes | The Opinion Terminal |

| AAdvantage | Yes | Miles for Opinions |

| SkyMiles | No | N/A |

| Frontier Miles | No | N/A |

| HawaiianMiles | No | N/A |

| TrueBlue | Yes | Jet Opinions |

| Rapid Rewards | Yes | Rewards for Opinions |

| MileagePlus | Yes | Opinion Miles Club |

Note: I just want to know that the surveys to earn 50 or 225 miles/points don’t mean that you automatically earn miles/points. There are factors that the surveys aren’t ideal or relevant for you (and you will earn no miles/points):

- Your age group

- Your education level

- Your occupation

- Your income group

- Certain activities you spent or have spent

- Certain cities or zip code of your residence

- Money spent on certain activities for the past 1, 3, or 6 months

- Usage of generic products or services

- Other generic answers/responses (there is no wrong or right answers/responses)

To be clear, it doesn’t mean that the surveys are right for you. It takes considerable time to find a survey to complete. Surprisingly, there is no penalty for not completing the survey.

Warning: It is essential to be honest with your responses when answering the questions. While there are no wrong answers, it is crucial to answering fairly with the question being asked. Failure to complete and/or answer the survey can result in loss of survey and a loss of miles/points in which that are given. The kinds of behavior (lying on the survey or commit fraud) can also deactivate your account. Surveying for someone is an act of violation of honestly and also constitutes fraud. I highly recommended reading the terms and conditions entirely. It would help if you didn’t let it happen.

Option 7: Other ways to earn miles

The airline’s frequent flyer programs have gotten partnered with the other partners with the business that agree with its program. It helps frequent flyer members to earn more miles/points.

| Airline’s Program | Other offers? | Offers* |

| Mileage Plan | Yes | 1-800-Flowers GCI Rover SoFi Teleflora |

| AAdvantage | Yes | Open up the Bask Bank account Stand up to Cancer |

| SkyMiles | Yes | Skybonus Lyft FTD Vinesse Wine Energy Plus Georgia National Gas Georgia Rapids Energy Illinois Energy Illinois Energy Solutions Ohio National Gas |

| Frontier Miles | Limited | Teleflora Vinesse Wine Transfer points (points.com) |

| HawaiianMiles | Yes | Ordering Travel Documents (Visa Central) Transfer points (points.com) Quicken Loans Long lists from Hawaiian Airlines’s website |

| TrueBlue | Limited | Amazon IHG Rewards Club |

| Rapid Rewards | Yes (Home/lifestyle and Specialty) | NRG Reliant (an NRG company) Make it counts Rewards E-Rewards Emergency Assistance Plus |

| MileagePlus | Yes and includes offers | Event Tickets and Audience Awards FTD Thanks Again Visa Central Quicken Loans NRG Reliant (an NRG company) MileagePlus Exclusives LifeLock Travelex eGift Cards |

*Offers subject to change without notice.

Conclusion: While meriting more miles for future trips can be exciting, it is crucial to know its program rules. I highly recommend reading the entire program’s rules (terms and conditions) and grasping those expectations. I hope more information helps with earning miles/points, even though you don’t often fly or have your plane trips postponed in 2021.

Bon Voyage, flyers!

References:

Blancaflor, M. (2020, Nov 25). The best airline credit cards of December 2020. ThePointsGuy. Retrieved from https://www.thepointsguy.com/guide/top-airline-credit-card-to-have/

Holzhauer, B. (2020, Oct 30). How Much Are Airline Miles Worth? 2020 Report. ValuePenguin. Retrieved from https://www.valuepenguin.com/travel/how-much-are-airline-miles-worth

Johnson, H. (2020, Sept 29). Frontier Miles: Is Frontier Airlines’ Rewards Program Worth It? ValuePenguin. Retrieved from https://www.valuepenguin.com/travel/frontier-airlines-reviews